Expense Account For Office Furniture . if you do not know your company's capitalization limit, speak to your accountant before recording this entry. since refrigerators have a useful life that is more than a year, you may include it under furniture, fixtures and equipments as. If the cost of the. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. When classifying supplies, you’ll need to. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. office furniture is categorized as office equipment or fixed assets under expenses. how to classify office supplies, office expenses, and office equipment on financial statements. By nature, it's a capital expenditure,.

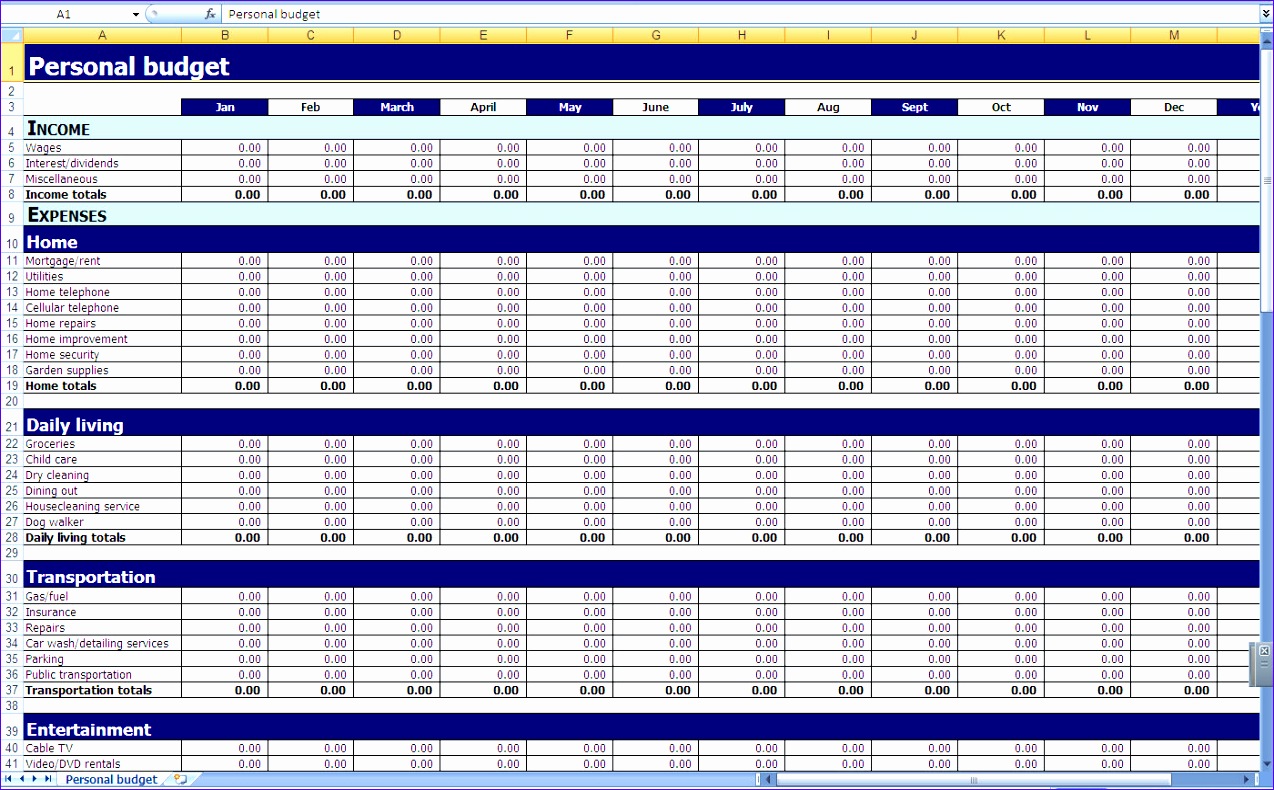

from www.exceltemplate123.us

there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. When classifying supplies, you’ll need to. how to classify office supplies, office expenses, and office equipment on financial statements. office furniture is categorized as office equipment or fixed assets under expenses. If the cost of the. since refrigerators have a useful life that is more than a year, you may include it under furniture, fixtures and equipments as. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. By nature, it's a capital expenditure,. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. if you do not know your company's capitalization limit, speak to your accountant before recording this entry.

11 Excel Templates for Expenses Excel Templates

Expense Account For Office Furniture By nature, it's a capital expenditure,. how to classify office supplies, office expenses, and office equipment on financial statements. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. When classifying supplies, you’ll need to. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. office furniture is categorized as office equipment or fixed assets under expenses. since refrigerators have a useful life that is more than a year, you may include it under furniture, fixtures and equipments as. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. If the cost of the. By nature, it's a capital expenditure,.

From www.svtuition.org

How to Decorate Accounting Office Accounting Education Expense Account For Office Furniture how to classify office supplies, office expenses, and office equipment on financial statements. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. When classifying supplies, you’ll need to. since refrigerators have a useful life that is more than a year, you may include. Expense Account For Office Furniture.

From www.bartleby.com

Answered Earnings, Supplies, Accounts Payable,… bartleby Expense Account For Office Furniture Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. how to classify office supplies, office expenses, and office equipment on financial statements. By nature, it's a capital expenditure,. If the cost of the. since refrigerators have a useful life that is more than a year, you may include it under furniture,. Expense Account For Office Furniture.

From tutorstips.com

Expenses Ledger account balancing Ledger Tutor's Tips Expense Account For Office Furniture if you do not know your company's capitalization limit, speak to your accountant before recording this entry. By nature, it's a capital expenditure,. office furniture is categorized as office equipment or fixed assets under expenses. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. When classifying. Expense Account For Office Furniture.

From vencru.com

Expense Report Templates Vencru Expense Account For Office Furniture since refrigerators have a useful life that is more than a year, you may include it under furniture, fixtures and equipments as. how to classify office supplies, office expenses, and office equipment on financial statements. When classifying supplies, you’ll need to. if you do not know your company's capitalization limit, speak to your accountant before recording this. Expense Account For Office Furniture.

From www.excelwordtemplate.com

Expense Report Template Excel Word Template Expense Account For Office Furniture If the cost of the. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. By nature, it's a capital expenditure,. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. since refrigerators have a useful life. Expense Account For Office Furniture.

From db-excel.com

Farm And Expense Spreadsheet Download — Expense Account For Office Furniture if you do not know your company's capitalization limit, speak to your accountant before recording this entry. how to classify office supplies, office expenses, and office equipment on financial statements. office furniture is categorized as office equipment or fixed assets under expenses. If the cost of the. since refrigerators have a useful life that is more. Expense Account For Office Furniture.

From madelynkruwwalter.blogspot.com

If Accounts Payable Has Debit Postings of 17 000 MadelynkruwWalter Expense Account For Office Furniture When classifying supplies, you’ll need to. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization. Expense Account For Office Furniture.

From db-excel.com

Monthly Expense Report Template Excel1 — Expense Account For Office Furniture If the cost of the. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. By nature, it's a capital expenditure,. When classifying supplies, you’ll need to. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. office furniture is categorized as office equipment or. Expense Account For Office Furniture.

From sarseh.com

Monthly Expense Report Template Excel Expense Account For Office Furniture office furniture is categorized as office equipment or fixed assets under expenses. When classifying supplies, you’ll need to. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. If the cost of the. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and. Expense Account For Office Furniture.

From www.myaccountingcourse.com

Chart of Accounts Example Format Structured Template Definition Expense Account For Office Furniture there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. office furniture is categorized as office equipment or fixed assets under expenses. If the. Expense Account For Office Furniture.

From cefzalpf.blob.core.windows.net

Is Furniture An Office Expense at Robert Krantz blog Expense Account For Office Furniture office furniture is categorized as office equipment or fixed assets under expenses. When classifying supplies, you’ll need to. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. By nature, it's a capital expenditure,. since refrigerators have a useful life that is more than a year, you. Expense Account For Office Furniture.

From www.excelwordtemplate.com

Expense Report Template Excel Word Template Expense Account For Office Furniture there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. office furniture is categorized as office equipment or fixed assets under expenses. When classifying supplies, you’ll need to. By nature, it's a capital expenditure,. how to classify office supplies, office expenses, and office equipment on financial statements.. Expense Account For Office Furniture.

From www.youtube.com

Journal Entries FURNITURE ENTRY ACCOUNTING ASSIGNMENT YouTube Expense Account For Office Furniture office furniture is categorized as office equipment or fixed assets under expenses. When classifying supplies, you’ll need to. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. there are a variety of office. Expense Account For Office Furniture.

From www.beginner-bookkeeping.com

Expense Form Template Expense Account For Office Furniture since refrigerators have a useful life that is more than a year, you may include it under furniture, fixtures and equipments as. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. what if the office furniture cost less than 1000 and we want to charge to the income &. Expense Account For Office Furniture.

From exoievedp.blob.core.windows.net

What Type Of Account Is Office Furniture at Ivy Olszewski blog Expense Account For Office Furniture By nature, it's a capital expenditure,. how to classify office supplies, office expenses, and office equipment on financial statements. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in. Expense Account For Office Furniture.

From handypdf.com

Expense Reimbursement Form Edit, Fill, Sign Online Handypdf Expense Account For Office Furniture By nature, it's a capital expenditure,. what if the office furniture cost less than 1000 and we want to charge to the income & expenditure statement in the year. if you do not know your company's capitalization limit, speak to your accountant before recording this entry. how to classify office supplies, office expenses, and office equipment on. Expense Account For Office Furniture.

From yourgymwiki.blogspot.com

Furniture, fixtures and equipment (accounting) Expense Account For Office Furniture if you do not know your company's capitalization limit, speak to your accountant before recording this entry. If the cost of the. there are a variety of office expenses that businesses need to account for, including rent, utilities, furniture, equipment, and supplies. since refrigerators have a useful life that is more than a year, you may include. Expense Account For Office Furniture.

From templatelab.com

40+ Expense Report Templates to Help you Save Money ᐅ TemplateLab Expense Account For Office Furniture if you do not know your company's capitalization limit, speak to your accountant before recording this entry. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. When classifying supplies, you’ll need to. how to classify office supplies, office expenses, and office equipment on financial statements. what if the office furniture. Expense Account For Office Furniture.